Many people fail to effectively prepare for retirement because it is very often considered a subject that can be dealt with in the future. But the adage “We’ll cross that bridge when we come to it” is definitely not applicable to retirement. A good and adequate preparation for retirement requires setting a goal of how much money you estimate you will need for retirement. It’s never too early for that.

This is why in Proverbs 21:5, Solomon says that “the plans of the diligent lead surely to plenty, but those of everyone who is hasty, surely to poverty” (NKJV). Here we see a contrast between two phases in the life of a person: the present and the future. Solomon wants his readers to understand the importance of taking time in the present to plan for the future. Not planning for your future will have a negative impact on your present, consequently leading to impulsive and thoughtless decisions. The financial decisions you make today will definitely affect your financial situation tomorrow.

Planning for retirement should not be delayed. Diligence and self-discipline are crucial to this very important aspect of your future. Planning for retirement is certainly not a simple process, and it does require the making of complex financial decisions.

How Much Money Will I Need to Retire?

There are different pension and retirement plans in various parts of the world. The common aspect of these plans is that they all ensure an income in retirement. The first question that most people should ask is: How much money will I need to retire? There is no specific answer to this question; however, there is a tendency to focus on the income only, implying that the retiree, one way or the other, will have to survive on the amount of money they will receive. This way of thinking discourages effective planning.

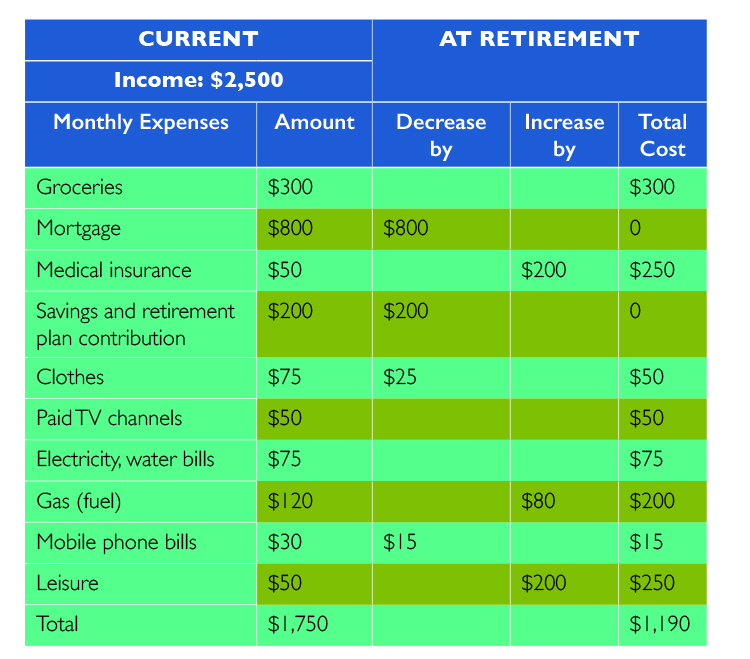

In order to avoid such a situation, instead of focusing solely on the income, your focus should be on the expenses that you anticipate having in retirement. One simple method is to make a list of all the expenses you currently have, determine which ones are most likely to decrease or to increase, and estimate by what approximate amount. For example, if you currently have a mortgage, you will most likely have paid it off by the time you retire. This is an expense that you will not have to worry about in retirement. And you may not need as much data on your mobile phone as you do now. On the other hand, expenses for such things as medical insurance or leisure activities would eventually increase. Of course, there is no “one size fits all” in this process; but the benefit is that it will assist you with planning for the financial aspect of your retirement, as well as help you evaluate your lifestyle, the use of your time, the kind of entertainment you prefer, etc. At the end of the day, these are what will dictate the way you spend your money. The following table is an example of how you might proceed:

Note that the above table does not include tithes (10 percent of income), offerings, and taxes. If we assume that your offerings equal 10 percent of your salary, and that the income tax rate is 15 percent, that will mean that 35 percent of your income should be added to your expenses.

This implies that the estimated expenses at retirement, which equal a total of $1,190, would represent only 65 percent of your monthly retirement income. So, your total income, if you were to retire today, would need to be $1,831 ($ 1,190 x 100 / 65), which represents 73 percent of your current income ($2,500). Based on this example, your objective should be to have a retirement income that is close to 73 percent of you pre-retirement income. Your objective should be a percentage rather than an amount, because the value of your money today will not be the same in, say, 15 or 20 years.

How Do I Choose My Pension or Retirement Plan?

Before choosing a pension plan, make sure you’re aware of all the financial resources that will be available to you at retirement, such as Social Security, employer pension, sale of property, etc., so that the amount of money you are investing for the future does not affect drastically and negatively your current lifestyle. Also, you need to make sure that the monthly contribution will not force you to draw from your emergency fund, which should always be at a level that will allow you to cover your expenses for at least six months.

The reduction of debt has a major impact on investment for retirement. It is essential that you repay outstanding debt as soon as possible so that these payments go toward retirement investments. The more debt you have, the more interest you pay; whereas the more investment you have, the more interest you gain.

Now that you have all these inputs, it will be easier for you to decide how much to contribute to either a personal pension plan or the one offered by your employer.

If you invest in a personal plan, it is important that you shop around in order to give yourself a wide spectrum of options, and follow these guidelines:

- Do not decide before you are sure you have obtained as much information as possible.

- Make a comparison between the different products that the providers are offering.

- Make sure that the contributions that are required will fit your current budget.

- Be aware of the charges and fees that you will have to pay, as well as the penalties if you miss a payment.

- Ask the following questions:

- What is the earliest that you can take your pension?

- What will be the penalty if you decide to take it earlier?

- Make sure you know how the funds will be invested.

- Be aware of the level of risk you are taking.

- If you are not sure, get advice from an independent financial adviser.

Solomon tells us to “go to the ant, you sluggard! Consider her ways and be wise, which, having no captain, overseer or ruler, provides her supplies in the summer, and gathers her food in the harvest” (Prov. 6:6-8, NKJV). Anyone who has an income needs to follow the example of the ant. Be your own overseer of your money, and begin preparing for the time when you will not be working anymore.